The Small Business Efficiency Act and Its Importance to AMERICA’S SMALL BUSINESSES

The President signed the Small Business Efficiency Act (SBEA) shortly after Senate approval. It was previously approved by the House of Representatives as a provision in the ABLE Act to off-set the costs associated with that proposal, then incorporated into the tax extenders legislation. This bill passed both chambers with large (and rare) bipartisan support.

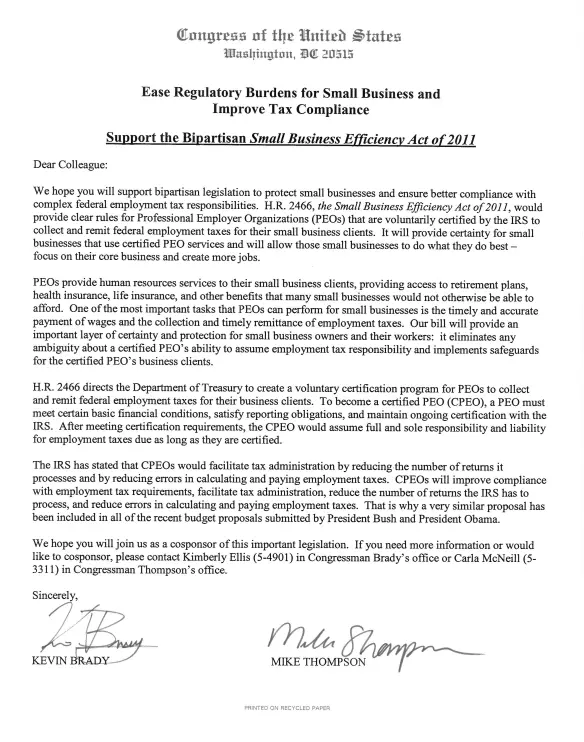

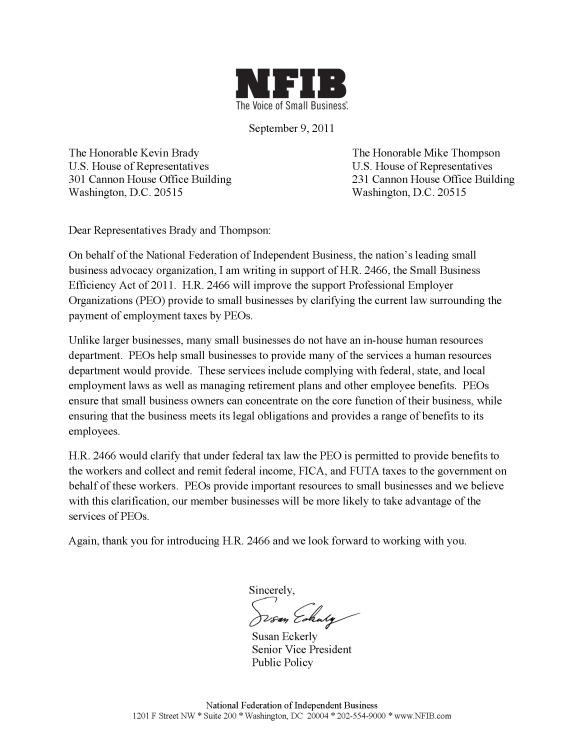

Passage of the SBEA is the culmination of many, many years of hard work by many people. Our Congressional champions – Representatives Kevin Brady (R-TX), Mike Thompson (D-CA), along with Senators Chuck Grassley (R-IA), and Bill Nelson (D-FL) worked tirelessly to find a legislative vehicle for the SBEA. Every NAPEO member who met with their Member of Congress, sent a letter, or weighed in, own part of this success. It is a victory for all those who worked so hard for so long to get this done. It at last provides certainty and legitimacy for us at the federal level.

What Does the SBEA do?

- Creates a certification process for PEOs within the IRS;

- Gives certified PEOs (CPEOs) the clear statutory authority to collect and remit federal employment taxes;

- Eliminates the wage base restart for PEO clients join or leave a PEO relationship; and,

- Codifies that customers of CPEOs will qualify for specified federal tax credits that the customers would be entitled to claim if there were no PEO relationship.

Next Steps

- The IRS must issue regulations to implement the SBEA. The regulations to implement the certification program must be issued by July 1. Any additional regulations implementing the SBEA must be issued by the IRS no later than January 1, 2016.

- The SBEA becomes effective on January 1, 2016.

UPDATE

The IRS plans to begin accepting applications for PEO certification beginning July 1, 2016. See IRS Announcement.